Zero-Deductible Car Insurance for Maserati

Zero-deductible car insurance for Maserati offers a compelling proposition for luxury vehicle owners. This comprehensive guide explores the intricacies of securing this type of coverage, delving into cost comparisons, policy features, the claims process, and long-term financial implications. We’ll examine the benefits and potential drawbacks, empowering you to make informed decisions about protecting your valuable investment.

Understanding the nuances of zero-deductible insurance for a Maserati requires careful consideration of various factors. From the model year and location to your driving history, several elements influence the premium. This guide will help you navigate the process of obtaining quotes, negotiating favorable rates, and understanding the claims procedures involved. We will also compare different insurance providers to help you find the best fit for your needs and budget.

Table of Contents

ToggleMaserati Insurance Costs

Insuring a Maserati, a symbol of luxury and high performance, comes with a unique set of considerations. Zero-deductible insurance, while offering peace of mind, significantly impacts the overall cost. Understanding these costs and the factors that influence them is crucial for responsible Maserati ownership.

Average Annual Premiums for Zero-Deductible Maserati Insurance

The annual cost of zero-deductible Maserati insurance varies considerably depending on several factors. The table below presents a comparative overview of average annual premiums from different hypothetical insurance providers. Note that these figures are for illustrative purposes and actual costs may differ.

| Insurance Provider | Maserati Model (Example) | Annual Premium (Estimate) | Coverage Details (Example) |

|---|---|---|---|

| Provider A | Ghibli | $5,000 | Comprehensive, Collision, Uninsured Motorist |

| Provider B | Levante | $6,500 | Comprehensive, Collision, Uninsured Motorist, Roadside Assistance |

| Provider C | Quattroporte | $7,200 | Comprehensive, Collision, Uninsured Motorist, Roadside Assistance, Rental Car Reimbursement |

| Provider D | GranTurismo | $8,000 | Comprehensive, Collision, Uninsured Motorist, Roadside Assistance, Rental Car Reimbursement, Gap Coverage |

Factors Influencing Zero-Deductible Maserati Insurance Costs

Several key factors significantly impact the cost of zero-deductible Maserati insurance. Understanding these allows for better financial planning and potentially negotiating more favorable rates.

- Maserati Model and Year: Newer models and high-performance variants generally command higher premiums due to repair costs and potential theft risks.

- Location: Insurance rates vary based on geographic location, reflecting factors such as crime rates, accident frequency, and the cost of repairs in a specific area.

- Driving History: A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents or violations can lead to significantly higher costs.

- Age and Gender of Driver: Younger drivers and those with less experience often face higher premiums due to increased risk assessment.

- Coverage Level: The extent of coverage chosen (comprehensive, collision, etc.) directly affects the premium amount. Zero-deductible policies inherently increase the cost compared to those with deductibles.

Example Add-on Coverages and Costs

Zero-deductible policies often allow for additional coverages to enhance protection. These add-ons come with associated costs, impacting the overall premium.

| Add-on Coverage | Description | Estimated Annual Cost | Provider Notes (Example) |

|---|---|---|---|

| Roadside Assistance | Towing, flat tire change, jump starts | $100 – $200 | Availability varies by provider |

| Rental Car Reimbursement | Covers rental car expenses while your Maserati is being repaired | $150 – $300 | Daily or per-incident limits may apply |

| Gap Coverage | Covers the difference between the actual cash value of your car and the outstanding loan amount | $200 – $400 | Highly recommended for leased or financed vehicles |

| Custom Parts Coverage | Covers the cost of replacing custom parts or modifications | Variable, based on modifications | Requires detailed documentation of modifications |

Policy Features and Benefits

Choosing a zero-deductible policy for a Maserati offers significant advantages, but it’s essential to weigh them against potential drawbacks.

Benefits of Zero-Deductible Maserati Insurance

The primary benefit of a zero-deductible policy is the convenience and peace of mind it provides. In the event of an accident or damage, you won’t have to pay out-of-pocket expenses upfront.

- Simplified Claims Process: No upfront cost means a smoother, faster claims process.

- Reduced Financial Burden: Eliminates the unexpected expense of a deductible, especially crucial for costly repairs on a luxury vehicle.

- Faster Repairs: The absence of a deductible can expedite the repair process as there’s no delay waiting for your payment.

Drawbacks of Zero-Deductible Maserati Insurance

While offering significant advantages, zero-deductible policies come with a higher premium cost. This needs careful consideration in terms of long-term financial implications.

- Higher Premiums: The most significant drawback is the substantially higher annual cost compared to policies with deductibles.

- Potential for Increased Premiums After Claims: Even with zero-deductible coverage, insurers may still raise premiums after a claim, particularly if it’s deemed your fault.

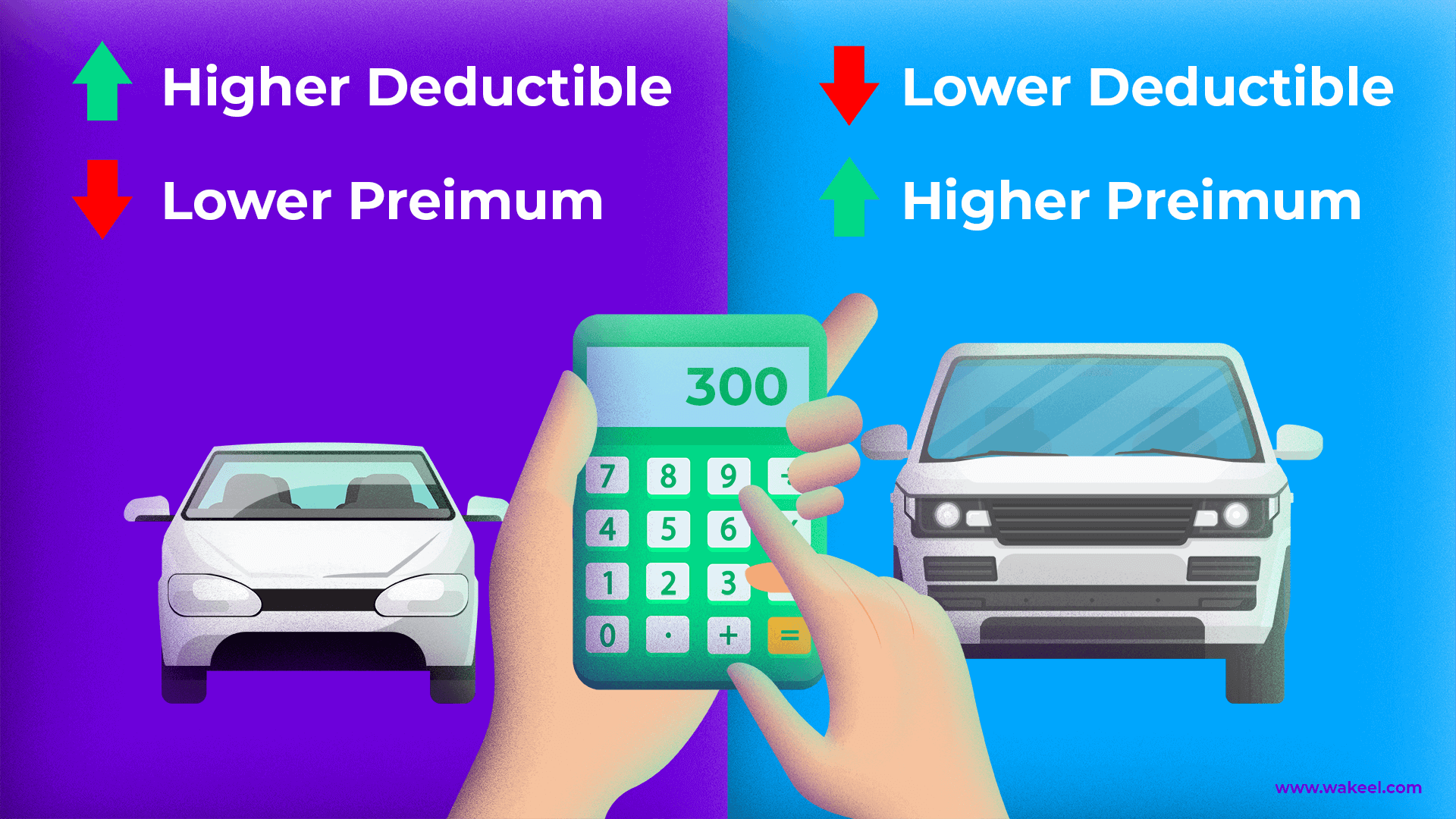

Comparison of Zero-Deductible and Standard Deductible Policies

The following comparison highlights the key differences between zero-deductible and standard deductible policies for Maserati owners.

- Zero-Deductible: Higher premiums, no out-of-pocket expenses in case of a claim, potentially faster claims processing.

- Standard Deductible: Lower premiums, out-of-pocket expense required in case of a claim, potentially slower claims processing due to deductible payment.

Finding Zero-Deductible Coverage

Securing zero-deductible insurance for your Maserati involves careful research and comparison shopping. Understanding the process and asking the right questions is crucial for finding the best coverage at a reasonable price.

Obtaining Quotes from Various Providers

Start by contacting several reputable insurance providers. Many offer online quote tools, allowing you to quickly compare options. Be prepared to provide detailed information about your Maserati, your driving history, and your desired coverage level.

Key Questions to Ask Insurance Providers, Zero-deductible car insurance for Maserati

Before committing to a policy, clarify any ambiguities and ensure you understand all aspects of the coverage.

- What specific coverages are included in the zero-deductible policy?

- What are the limitations or exclusions of the policy?

- What is the claims process, and how long does it typically take?

- What factors might affect my premium in the future (e.g., accidents, violations)?

- What discounts are available?

Tips for Negotiating Lower Premiums

Negotiating a lower premium is possible; leverage your clean driving record, explore discounts, and compare quotes aggressively.

- Bundle Policies: Combining your Maserati insurance with other policies (home, life) can often lead to discounts.

- Safe Driving Discounts: Highlight your clean driving record and any defensive driving courses you’ve completed.

- Compare Quotes Aggressively: Obtain quotes from multiple providers to find the most competitive rates.

- Consider Increasing Your Deductible (if acceptable): Even a small deductible can significantly lower your premium, although it’s counter to the zero-deductible goal.

Claims Process: Zero-deductible Car Insurance For Maserati

Understanding the claims process for your zero-deductible Maserati insurance is crucial. Knowing what to expect can streamline the process and ensure a smoother experience.

Claims Process for Zero-Deductible Maserati Insurance

The claims process typically involves reporting the incident to your insurer promptly, providing necessary documentation, and cooperating with their investigation. Since there’s no deductible, the focus is on assessing the damage and arranging repairs.

Required Documentation When Filing a Claim

Gather all relevant documentation to expedite the claims process.

- Police report (if applicable)

- Photos and videos of the damage

- Details of the other driver(s) involved (if applicable)

- Your insurance policy information

- Repair estimates from authorized Maserati repair centers

Scenarios Covered Under Zero-Deductible Maserati Insurance

Zero-deductible policies typically cover a wide range of scenarios, including accidents, theft, vandalism, and even some instances of natural disasters. However, specific coverage details vary by policy.

- Collision damage from an accident

- Comprehensive damage from events like hail, fire, or theft

- Damage from vandalism or malicious acts

Financial Implications

The long-term financial impact of choosing a zero-deductible policy needs careful consideration. While eliminating upfront costs is appealing, the higher premiums need to be weighed against the potential savings from avoiding deductibles.

Long-Term Financial Implications of Zero-Deductible vs. Standard Deductible Policies

A hypothetical comparison over five years illustrates the financial implications.

| Policy Type | Annual Premium | Total Premium (5 years) | Deductible Cost (Hypothetical Claim) |

|---|---|---|---|

| Zero-Deductible | $7,000 | $35,000 | $0 |

| Standard Deductible ($1,000) | $5,000 | $25,000 | $1,000 (if a claim occurs) |

Note: This is a simplified example. Actual costs will vary based on numerous factors.

Strategies for Managing Higher Premiums

Several strategies can help manage the increased cost of zero-deductible insurance.

- Careful Budgeting: Factor the higher premiums into your monthly budget.

- Seeking Discounts: Explore all available discounts offered by your insurer.

- Reviewing Coverage Regularly: Periodically review your coverage to ensure you’re not paying for unnecessary add-ons.

Insurance Provider Comparisons

Several major insurance providers offer zero-deductible options for Maseratis. Comparing their offerings, reputations, and customer service experiences is essential for making an informed decision.

Comparison of Insurance Providers

The following table compares three hypothetical insurance providers. Remember that actual costs and coverage details can vary.

| Insurance Provider | Annual Premium Range (Estimate) | Coverage Highlights | Customer Service Rating (Example) |

|---|---|---|---|

| Provider A | $6,000 – $8,000 | Comprehensive coverage, roadside assistance, rental car reimbursement | 4.5 stars |

| Provider B | $5,500 – $7,500 | Comprehensive coverage, accident forgiveness, claims management app | 4 stars |

| Provider C | $7,000 – $9,000 | Comprehensive coverage, concierge service, specialized Maserati repair network | 4.2 stars |

Reputation and Customer Service

Researching each provider’s reputation and customer service is crucial. Consider the following aspects:

- Claims Processing Speed: How quickly do they typically process claims?

- Customer Reviews: Examine online reviews and ratings to gauge customer satisfaction.

- Accessibility and Responsiveness: How easy is it to contact them and get assistance when needed?

Illustrative Scenarios

Real-world scenarios can better illustrate the benefits and potential drawbacks of zero-deductible Maserati insurance.

Minor Accident Scenario

Imagine a minor fender bender in a parking lot. With zero-deductible insurance, the repair costs (estimated at $2,000) are covered entirely by the insurer. The claims process involves reporting the incident, providing photos of the damage, and potentially exchanging information with the other driver. The repair is scheduled and completed without any out-of-pocket expense for the Maserati owner.

Major Accident Scenario

Source: cloudfront.net

Consider a more significant accident resulting in extensive damage, requiring a complete rebuild (estimated at $50,000). With zero-deductible coverage, the insurer covers the entire repair cost. However, the claims process is more involved, requiring a detailed police report, comprehensive documentation, and potentially an appraisal of the vehicle’s damage. While the owner avoids a large upfront deductible payment, the inconvenience and time involved in the repair process are still significant.

Scenario Where High Cost Outweighs Benefits

A Maserati owner with a spotless driving record and low risk profile might find that the substantial increase in premium for zero-deductible insurance outweighs the benefits. If the annual premium increase significantly exceeds the potential deductible cost over several years, a policy with a higher deductible might be a more financially prudent choice. This decision requires a careful assessment of individual risk tolerance and financial circumstances.

Closing Summary

Securing zero-deductible car insurance for your Maserati involves a careful assessment of your needs and budget. While the convenience of no out-of-pocket expenses in case of an accident is attractive, it’s crucial to weigh the higher premiums against the potential long-term costs. By understanding the factors influencing premiums, comparing providers, and diligently managing your policy, you can effectively protect your investment while maintaining financial prudence.

Query Resolution

What factors affect the cost of zero-deductible Maserati insurance beyond the model year and location?

Your driving record (accidents, tickets), credit score, and the level of coverage (comprehensive vs. liability) all significantly influence the premium.

Can I add roadside assistance to a zero-deductible Maserati insurance policy?

Yes, many insurers offer roadside assistance as an add-on feature for an additional cost. This typically includes towing, lockout service, and other emergency roadside services.

How long does the claims process typically take with zero-deductible Maserati insurance?

The timeframe varies depending on the insurer and the complexity of the claim. Minor claims might be processed quickly, while major accidents could take longer.

What if I am at fault in an accident with my Maserati? Does the zero-deductible still apply?

Generally, yes, even if you are at fault, a zero-deductible policy means you won’t pay out-of-pocket for repairs, assuming the accident is covered under your policy terms. However, your premiums may increase in subsequent years.