Why car insurance rates are increasing in 2025

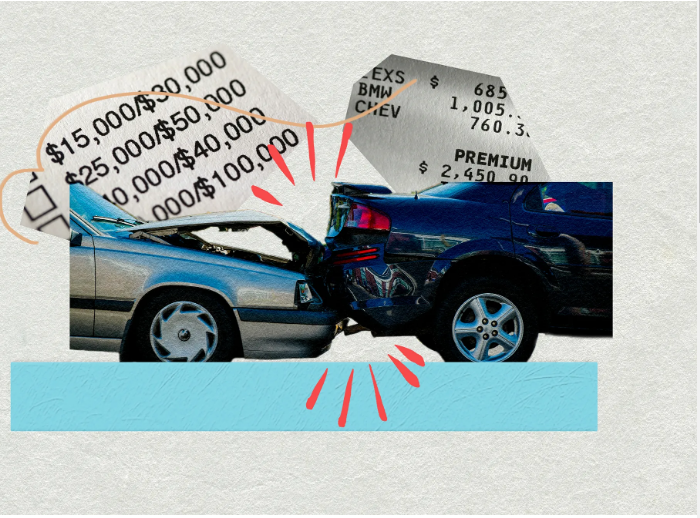

Why car insurance rates are increasing in 2025 is a question on many drivers’ minds. This significant rise isn’t due to a single factor, but rather a confluence of economic, technological, and societal shifts. From soaring repair costs driven by inflation and the complexity of modern vehicles to a rise in accident frequency and severity, numerous elements contribute to this upward trend.

Understanding these contributing factors is crucial for both drivers and the insurance industry itself.

The increasing cost of car parts, labor, and medical care significantly impacts insurance premiums. Economic factors such as inflation and rising interest rates further exacerbate the problem. Simultaneously, changes in insurance company practices and the lingering effects of supply chain disruptions add to the complexity of the situation. This analysis will explore each of these contributing factors in detail, providing a comprehensive understanding of why car insurance premiums are climbing in 2025.

Table of Contents

ToggleRising Car Insurance Premiums in 2025

The cost of car insurance is steadily increasing, and 2025 is expected to see a further rise in premiums. Several interconnected factors contribute to this trend, impacting both insurance companies and policyholders. This article will explore the key reasons behind this escalation, providing insights into the complexities of the automotive insurance market.

Increased Repair Costs

Source: cloudinary.com

The escalating cost of vehicle repairs is a major driver of higher insurance premiums. This increase stems from both the rising price of car parts and the increased cost of labor.

Advancements in vehicle technology, particularly the incorporation of sophisticated electronic systems and advanced driver-assistance systems (ADAS), significantly contribute to higher repair expenses. Repairing or replacing these complex components often requires specialized tools, expertise, and extensive diagnostic procedures, all adding to the overall cost.

Certain car parts have experienced particularly dramatic price increases. For instance, sensors used in ADAS, specific electronic control units (ECUs), and certain body panels are examples of components with significantly inflated costs. The scarcity of certain microchips used in modern vehicles also exacerbates this issue.

The following table compares average repair costs for common car damage in 2024 versus projected costs for 2025. These figures are illustrative and may vary depending on the vehicle make, model, and location.

| Type of Damage | Average Repair Cost (2024) | Projected Average Repair Cost (2025) | Percentage Increase |

|---|---|---|---|

| Minor Bumper Damage | $1,000 | $1,200 | 20% |

| Moderate Collision Damage | $3,500 | $4,200 | 20% |

| Major Collision Damage | $8,000 | $10,000 | 25% |

| Windshield Replacement | $500 | $600 | 20% |

Inflation and Economic Factors

Source: knowherenews.com

General inflation significantly impacts the cost of insurance. As the prices of goods and services rise, so do the costs associated with settling insurance claims, including medical expenses, repair costs, and administrative overhead.

Rising interest rates also affect insurance companies. Higher interest rates increase the cost of borrowing money, impacting the reserves insurance companies need to maintain to cover future payouts. This necessitates adjustments in premium pricing to offset these increased financial burdens.

Historically, a strong correlation exists between inflation rates and car insurance premium increases. For example, a 5% increase in inflation often correlates with a 2-4% increase in average insurance premiums, although this can vary based on other factors.

- Rising inflation rates

- Increased interest rates

- Higher material costs

- Increased labor costs

- Fluctuations in the global economy

Higher Frequency and Severity of Accidents, Why car insurance rates are increasing in 2025

Data suggests an increase in both the frequency and severity of car accidents in recent years. Several factors contribute to this trend, including distracted driving, increased traffic congestion, and inadequate road infrastructure in certain areas.

Accident statistics vary across demographics and geographical regions. For instance, younger drivers generally have higher accident rates, while certain urban areas may experience more frequent accidents due to higher traffic density. The severity of accidents also varies, with some resulting in minor damage while others involve significant injuries and property damage.

Distracted driving, particularly cell phone use, is a significant contributing factor to increased accident claims. Similarly, speeding, impaired driving, and adverse weather conditions also contribute to more severe accidents and higher insurance payouts.

A direct correlation exists between accident severity and insurance payouts. More severe accidents typically result in higher claim costs due to increased medical expenses, extensive vehicle repairs, and potential legal settlements.

Increased Claims Costs

The cost of settling insurance claims is rising due to several interconnected factors. These factors contribute to a substantial increase in overall insurance expenses.

Litigation and legal fees play a significant role in higher claim payouts. Increased legal involvement, including more frequent lawsuits and higher attorney fees, leads to greater expenses for insurance companies. This, in turn, necessitates higher premiums to maintain solvency.

The rising cost of medical care significantly impacts insurance claim settlements. Treatment for injuries sustained in car accidents can be expensive, leading to substantial increases in medical claim payouts. This escalating cost of healthcare directly translates to higher insurance premiums.

A breakdown of claim costs by accident type might show that collision claims are generally more expensive than comprehensive claims due to the higher potential for injury and vehicle damage.

Changes in Insurance Company Practices

Insurance companies are constantly refining their underwriting practices and pricing models to reflect changing risk assessments and economic conditions.

Data analytics plays a crucial role in how insurance companies assess risk and set premiums. By analyzing vast datasets, insurers can identify patterns and correlations, enabling more accurate risk profiling and individualized premium calculations.

Different insurance companies employ varying pricing models, leading to differences in consumer costs. Some insurers might prioritize factors like driving history and credit score, while others may place more emphasis on vehicle type and location.

The implementation of new risk assessment methodologies can lead to significant changes in individual insurance rates. For example, the incorporation of telematics data, which tracks driving behavior, can lead to lower premiums for safe drivers but potentially higher premiums for those with risky driving habits.

Impact of Supply Chain Issues

Disruptions to global supply chains have significantly impacted the availability of car parts, leading to longer repair times and increased costs.

Delays in repairs due to part shortages directly impact insurance costs. When repairs are delayed, rental car expenses increase, and the overall cost of settling claims rises. This ultimately translates to higher insurance premiums.

Certain parts, particularly those with specialized electronics or those sourced from specific regions prone to supply chain disruptions, have experienced significant shortages. This scarcity drives up prices and further exacerbates the problem.

The impact of supply chain issues can be visualized as a cascading effect: Part shortages lead to repair delays, which in turn increase rental car costs and labor expenses, ultimately resulting in higher claim payouts and subsequently, higher insurance premiums. This ripple effect significantly contributes to the overall increase in insurance costs.

Technological Advancements in Vehicles

The increasing sophistication of modern vehicles, particularly the integration of advanced driver-assistance systems (ADAS), has a complex impact on accident rates and repair costs.

While ADAS features aim to enhance safety and potentially reduce accident rates, the complexity of these systems increases repair times and costs. Repairing or replacing damaged ADAS components can be extremely expensive, requiring specialized tools and expertise.

Comparing the repair costs of traditional vehicles versus vehicles with advanced technology reveals a significant difference. Modern vehicles with complex electronic systems often have substantially higher repair costs than their simpler predecessors.

The cost implications of repairing or replacing sophisticated electronic components, such as radar sensors, cameras, and control modules, are substantial. The high cost of these parts and the specialized labor required to repair or replace them contribute significantly to the overall increase in insurance premiums.

Wrap-Up: Why Car Insurance Rates Are Increasing In 2025

In conclusion, the increase in car insurance rates in 2025 is a multifaceted issue stemming from a complex interplay of economic pressures, technological advancements, and evolving accident patterns. While the rising costs of repairs, the impact of inflation, and the increased frequency and severity of accidents are major contributors, understanding these factors allows for a more informed approach to managing personal insurance costs and navigating the changing landscape of the automotive insurance market.

Proactive measures, such as safer driving habits and thorough comparison shopping, can help mitigate the impact of these rising premiums.

Popular Questions

What can I do to lower my car insurance premiums?

Consider factors such as your driving record, the type of vehicle you drive, and your location. Shop around for different insurance providers and compare quotes. Maintaining a good driving record and opting for safety features can also influence your premiums.

Are these increases affecting all drivers equally?

No, the impact varies based on several factors, including driving history, location, vehicle type, and the specific insurance provider. Younger drivers and those with poor driving records may experience more significant increases.

Will these rates continue to rise in future years?

Predicting future insurance rates is difficult, as it depends on numerous economic and societal factors. However, given the ongoing trends discussed, further increases are a possibility.