How to Compare Car Insurance Quotes

How to compare car insurance quotes effectively is crucial for securing the best coverage at the most competitive price. Navigating the world of car insurance can feel overwhelming, with a myriad of providers, coverage options, and jargon. This guide simplifies the process, empowering you to make informed decisions and find a policy that perfectly suits your needs and budget.

We’ll explore the key components of a car insurance quote, different coverage types, and effective strategies for comparing quotes from multiple insurers. By the end, you’ll be confident in your ability to compare apples to apples and choose the policy that offers the optimal balance of protection and affordability.

Understanding the intricacies of car insurance quotes is the first step toward securing the best possible coverage. This involves familiarizing yourself with the various components of a quote, including premiums, deductibles, and coverage limits. Factors like your driving history, vehicle type, and location significantly influence the cost. We will delve into the specifics of common coverage types such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, providing clear explanations and examples to ensure a comprehensive understanding.

Table of Contents

ToggleUnderstanding Car Insurance Quotes

Car insurance quotes are essential tools for comparing coverage options and pricing from different insurers. Understanding the components of a quote, the factors influencing its cost, and the various coverage types available is crucial for making an informed decision.

Components of a Car Insurance Quote

A typical car insurance quote includes several key components: premium (the total cost of the policy), deductible (the amount you pay out-of-pocket before your insurance coverage kicks in), coverage limits (the maximum amount your insurer will pay for a covered claim), and policy details (specifics of your coverage, exclusions, and terms).

Factors Influencing Car Insurance Costs

Several factors influence the cost of car insurance. These include your driving history (accidents, tickets), age and driving experience, vehicle type and value, location (higher crime rates generally mean higher premiums), credit score (in some states), and the coverage level you choose. For example, a young driver with a poor driving record living in a high-crime area will likely pay more than an older driver with a clean record living in a safer area driving an older, less valuable car.

Common Car Insurance Coverage Types

Most car insurance quotes include various coverage options. Understanding these is vital for choosing the right policy. Common types include liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments.

Comparison of Common Car Insurance Coverage Options

| Coverage Type | Description | Typical Cost Factors | Benefits |

|---|---|---|---|

| Liability | Covers injuries or damages you cause to others. | Driving record, location, coverage limits. | Protects you from significant financial losses if you cause an accident. |

| Collision | Covers damage to your car in an accident, regardless of fault. | Vehicle value, deductible, driving record. | Repairs or replaces your car after a collision. |

| Comprehensive | Covers damage to your car from non-collision events (e.g., theft, vandalism, weather). | Vehicle value, deductible, location. | Protects against various risks beyond accidents. |

| Uninsured/Underinsured Motorist | Covers injuries or damages caused by an uninsured or underinsured driver. | State requirements, driving record. | Protects you in accidents involving at-fault uninsured drivers. |

Gathering Car Insurance Quotes

Obtaining multiple car insurance quotes is crucial for comparison. Several methods exist, each with advantages and disadvantages.

Methods for Obtaining Car Insurance Quotes Online

Many insurers offer online quote tools. You can also use comparison websites that allow you to request quotes from multiple insurers simultaneously. Directly contacting insurers via phone or email is another option, although this can be more time-consuming.

Advantages and Disadvantages of Online Comparison Tools

Source: carinsurancerates.com

Online comparison tools offer convenience and speed, allowing you to compare quotes from various insurers in one place. However, they may not include all insurers, and the displayed quotes might not reflect your specific needs precisely. Directly contacting insurers can provide a more personalized experience but requires more time and effort.

Information Needed for Accurate Quotes

To receive accurate quotes, insurers require information about your vehicle (year, make, model), driving history, address, desired coverage levels, and sometimes your credit score (depending on the state). Providing accurate and complete information ensures the quotes you receive are relevant and reliable.

Step-by-Step Guide to Requesting Quotes

- Gather necessary information (vehicle details, driving history, etc.).

- Use online comparison tools or visit insurer websites directly.

- Complete the quote request forms accurately.

- Compare the quotes received, focusing on coverage, premiums, and deductibles.

- Contact insurers directly to clarify any questions or concerns.

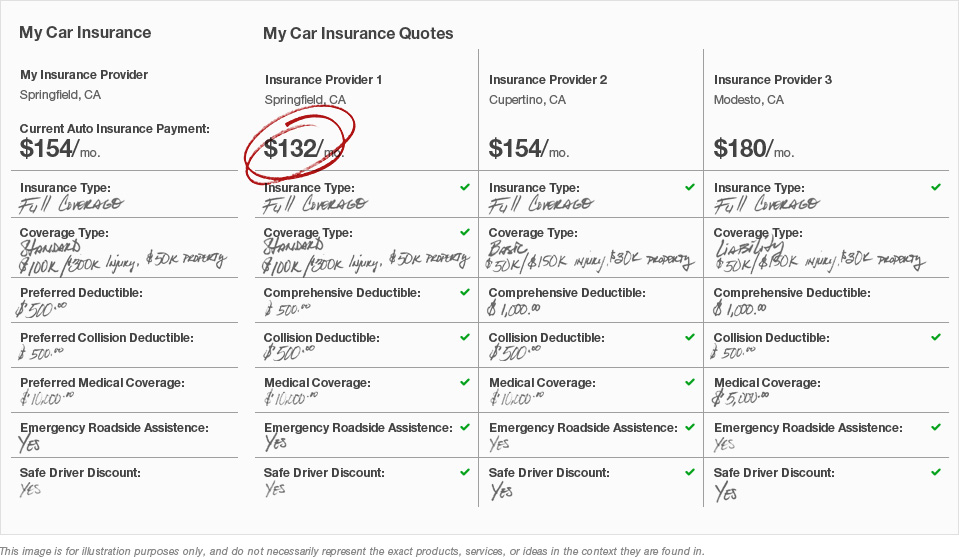

Comparing Car Insurance Quotes

Once you have gathered multiple quotes, carefully compare them to identify the best option for your needs. Pay close attention to the format, coverage details, and pricing.

Comparing Quote Formats

Different insurers use varying quote formats. Some may present information concisely, while others provide more detailed explanations. Regardless of the format, ensure you understand all aspects of the coverage offered before making a decision. Look for clear explanations of premiums, deductibles, and coverage limits.

Coverage Options and Exclusions

Carefully compare the specific coverage options included in each quote. Pay close attention to exclusions – circumstances or types of damage not covered by the policy. A seemingly cheaper quote may have significant exclusions that make it less valuable in the long run.

Interpreting Policy Deductibles and Premiums

The deductible is the amount you pay out-of-pocket before your insurance coverage begins. A higher deductible usually results in a lower premium. The premium is the total cost of your insurance policy. Understanding the relationship between these two factors is key to finding a balance that suits your budget and risk tolerance.

Comparison Data: Bullet Point Highlights

Source: ytimg.com

To facilitate comparison, organize the information using bullet points. For example:

- Insurer A: Low premium, high deductible, good coverage.

- Insurer B: Moderate premium, moderate deductible, comprehensive coverage.

- Insurer C: High premium, low deductible, excellent coverage with few exclusions.

Analyzing Coverage Details

A thorough analysis of coverage details is essential to ensure you have adequate protection. Liability coverage, collision and comprehensive coverage, and uninsured/underinsured motorist coverage are crucial aspects to consider.

Importance of Understanding Liability Coverage, How to compare car insurance quotes

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It’s typically legally required and covers medical bills, property damage, and legal fees. Adequate liability limits are crucial to prevent significant personal financial loss.

Collision and Comprehensive Coverage: Benefits and Limitations

Collision coverage pays for repairs or replacement of your vehicle after an accident, regardless of fault. Comprehensive coverage protects against damage from events other than collisions (theft, fire, vandalism, etc.). Both typically have deductibles, and comprehensive coverage may exclude certain events depending on the policy.

Choosing Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident caused by a driver without insurance or with insufficient coverage. It’s crucial to have this coverage, especially in areas with a high percentage of uninsured drivers. The coverage limit should be sufficient to cover potential medical bills and vehicle repairs.

Comparison of Coverage Limits Offered by Different Insurers

| Insurer | Liability Limits | Collision Deductible | Comprehensive Deductible |

|---|---|---|---|

| Insurer A | $100,000/$300,000 | $500 | $500 |

| Insurer B | $250,000/$500,000 | $1000 | $1000 |

| Insurer C | $500,000/$1,000,000 | $0 | $0 |

Choosing the Best Car Insurance Policy

Selecting the best car insurance policy involves prioritizing your needs, considering your risk tolerance and budget, and potentially negotiating with insurers.

Prioritizing Needs When Comparing Quotes

Consider your individual risk tolerance and financial situation. If you have a newer, more expensive car, higher coverage limits and lower deductibles might be preferable, even if the premium is higher. If you have an older car and a tighter budget, a higher deductible with lower premiums might be more suitable.

Selecting a Policy Aligned with Risk Tolerance and Budget

Balance your desired coverage levels with your budget. A higher premium offers greater protection but comes at a higher cost. Assess your risk tolerance and choose a policy that provides adequate coverage without straining your finances.

Tips for Negotiating with Insurance Providers

Consider bundling your car insurance with other types of insurance (homeowners, renters) to potentially receive discounts. Maintain a good driving record, and inquire about discounts for safety features in your vehicle. Be prepared to compare quotes from multiple insurers to leverage competitive pricing.

Scenarios Where Different Coverage Options Are Beneficial

For example, comprehensive coverage is beneficial if you live in an area prone to hailstorms or theft. Uninsured/underinsured motorist coverage is crucial in areas with many uninsured drivers. Collision coverage is important if you drive an older car that’s more likely to be involved in accidents.

Additional Considerations: How To Compare Car Insurance Quotes

After choosing a policy, carefully review the policy documents, understand the process for making changes, and be aware of how claims might affect future premiums.

Importance of Reviewing Policy Documents

Thoroughly review your policy documents to understand the specific coverage details, exclusions, and terms and conditions. Ensure you understand what is and isn’t covered before a claim arises.

Making Changes to a Policy After Purchase

Most insurers allow policy changes, but this might affect your premium. Contact your insurer to discuss any changes you need to make, such as adding a driver or changing your coverage levels.

Implications of Filing a Claim on Future Premiums

Filing a claim can increase your premiums in the future. Insurers assess risk based on claims history, so multiple claims might lead to higher premiums. However, the cost of repairing damage yourself might be far greater than a premium increase.

Checklist for Reviewing and Comparing Car Insurance Quotes

- Premium cost

- Deductibles

- Liability coverage limits

- Collision and comprehensive coverage

- Uninsured/underinsured motorist coverage

- Exclusions

- Customer service reputation

- Discounts offered

Last Word

Ultimately, comparing car insurance quotes is a multifaceted process requiring careful consideration of various factors. By following the steps Artikeld in this guide – from gathering quotes online and analyzing coverage details to prioritizing your needs and negotiating with providers – you can confidently select a policy that aligns with your individual risk tolerance and financial resources. Remember, the best policy isn’t just the cheapest; it’s the one that provides the most appropriate level of protection at a price you can comfortably afford.

Take control of your insurance costs and secure the peace of mind you deserve.

General Inquiries

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in after an accident.

How often should I compare car insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, change in driving record, move to a new location).

Can I get car insurance quotes without providing my personal information?

While some comparison websites offer initial estimates without full details, you’ll generally need to provide some personal information (driving history, address, etc.) to receive accurate quotes.

What is the difference between liability and collision coverage?

Liability coverage protects others if you cause an accident, while collision coverage repairs your vehicle regardless of fault.