Disability Insurance for High-Income Tech Professionals in the USA

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Disability insurance for high-income earners in tech USA is a critical yet often overlooked aspect of financial planning. Tech professionals, known for their high earning potential and demanding careers, face unique vulnerabilities. A disabling injury or illness can not only disrupt their lucrative careers but also threaten their carefully constructed financial security. This comprehensive guide explores the specific needs of this demographic, examining various policy options, cost considerations, and strategies for securing adequate protection.

Understanding the nuances of disability insurance is crucial for high-income tech professionals in the USA. This involves carefully considering factors such as policy types (short-term, long-term, own-occupation, any-occupation), benefit periods, waiting periods, and the definition of disability itself. Furthermore, navigating the complexities of premiums, tax implications, and integrating disability insurance into a broader financial plan requires careful planning and expert advice.

This guide aims to provide the necessary knowledge to make informed decisions.

Table of Contents

ToggleUnderstanding the Needs of High-Income Tech Professionals

High-income earners in the US tech industry face unique financial circumstances and vulnerabilities regarding disability. Their high salaries and often demanding careers create a significant dependency on income, making the consequences of disability particularly severe. This section will explore the specific financial situations, risks, and typical income levels of these professionals, comparing their disability insurance needs to those in other professions.

Financial Situations and Risks of High-Income Tech Professionals

Tech professionals in high-earning roles often have complex financial portfolios including significant investments, mortgages, and family responsibilities. A disability can severely disrupt these carefully constructed financial plans, leading to substantial financial losses and lifestyle changes. The high cost of living in many tech hubs further exacerbates these risks. The loss of income can not only jeopardize their current lifestyle but also their ability to meet long-term financial goals like retirement or children’s education.

Income Levels and Career Paths in US Tech

The definition of “high-income” varies, but in the US tech sector, it generally refers to annual incomes exceeding $200,000, often reaching significantly higher levels for senior engineers, executives, and founders. These individuals often hold positions like software engineers, data scientists, product managers, and leadership roles within established companies or startups.

Comparison of Disability Insurance Needs Across Professions

The table below highlights the differing disability insurance needs between high-income tech professionals and those in other professions. The needs are directly related to income level, career stability, and potential earning capacity following a disability.

| Profession | Average Income | Disability Risk | Insurance Needs |

|---|---|---|---|

| High-Income Tech Professional | >$200,000 | High (demanding work, sedentary lifestyle) | High coverage, long-term benefits, own-occupation definition |

| Physician | $200,000+ | Moderate (physical demands, potential for burnout) | Significant coverage, long-term benefits, own-occupation preferred |

| Teacher | <$75,000 | Low (generally stable, less physically demanding) | Basic coverage, shorter benefit period, may not require own-occupation |

| Construction Worker | $60,000 – $80,000 | High (physically demanding, high injury risk) | Adequate coverage, shorter benefit period, any-occupation may suffice |

Types of Disability Insurance Policies

Understanding the various types of disability insurance policies is crucial for high-income tech professionals. This section will detail the differences between individual and group policies, along with descriptions of various policy types, comparing their benefits and drawbacks for this specific demographic.

Individual vs. Group Disability Insurance

Individual disability insurance policies offer greater flexibility and customization but typically come with higher premiums. Group policies, often offered through employers, are generally more affordable but often provide less comprehensive coverage and may not be portable upon job change. For high-income tech professionals, individual policies often provide the necessary coverage level to replace their substantial income.

Policy Types: Short-Term, Long-Term, Own-Occupation, Any-Occupation

- Short-Term Disability Insurance: Provides income replacement for a limited period (typically 3-6 months) due to a disability. Suitable for temporary injuries or illnesses.

- Long-Term Disability Insurance: Offers income replacement for an extended period (potentially until retirement age) following a disabling event. Crucial for high-income earners due to the long recovery time from some disabilities.

- Own-Occupation Disability Insurance: Defines disability as the inability to perform the duties of your specific occupation. Beneficial for tech professionals whose skills might not be transferable to other roles.

- Any-Occupation Disability Insurance: Defines disability as the inability to perform any occupation for which you are reasonably suited by education, training, or experience. Generally less expensive but offers less protection for high-income specialists.

Policy Features and Considerations

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Source: investopedia.com

Several key features significantly impact the effectiveness of a disability insurance policy. This section discusses the importance of benefit periods, waiting periods, the definition of disability, and crucial policy riders for high-income tech professionals. A hypothetical policy example will illustrate these considerations.

Benefit Periods and Waiting Periods

The benefit period specifies the length of time benefits are paid. Longer benefit periods are essential for high-income tech professionals, potentially covering the duration until retirement or complete recovery. The waiting period is the time between the onset of disability and the commencement of benefits; shorter waiting periods are preferable, but usually come with higher premiums.

Definition of Disability: Own-Occupation vs. Any-Occupation

For high-income tech professionals, an “own-occupation” definition is crucial. A disabling injury might prevent them from performing their specialized tech role, even if they could theoretically perform a less demanding job. An “any-occupation” definition would likely deny benefits in such a scenario.

Crucial Policy Riders and Provisions

Cost-of-living adjustments (COLA) protect against inflation, ensuring benefits maintain purchasing power over time. Future insurability options allow increasing coverage later without undergoing further medical underwriting, particularly valuable as income grows.

Hypothetical Policy for a High-Income Tech Professional

A hypothetical policy for a $300,000-earning software engineer might include a long-term policy with a 90-day waiting period, a benefit period to age 65, an own-occupation definition, a 60% income replacement benefit, COLA, and a future insurability option. This provides robust protection tailored to their specific needs and income level.

Cost and Affordability

The cost of disability insurance for high-income tech professionals is influenced by several factors, including income level, age, occupation, health, and policy features. This section will explore these factors, compare premium costs, and discuss strategies for managing costs while maintaining adequate coverage.

Factors Influencing Cost

Higher income levels lead to higher premiums because the insurance company is covering a greater potential loss. Age is another significant factor; younger individuals typically enjoy lower premiums. Health status, occupation (risk level), and policy features (benefit level, waiting period, definition of disability) all influence the final cost.

You also can investigate more thoroughly about exotic luxury cars like Pagani and Ferrari for rent USA to enhance your awareness in the field of exotic luxury cars like Pagani and Ferrari for rent USA.

Premium Cost Comparison

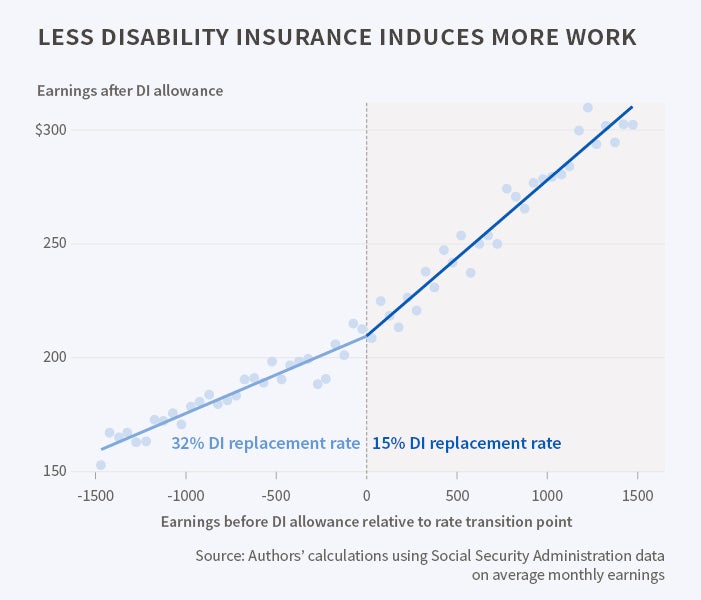

Source: nber.org

Generally, long-term, own-occupation policies with higher benefit levels and shorter waiting periods are more expensive than short-term, any-occupation policies with lower benefits and longer waiting periods. However, the increased cost of the former is often justified by the greater financial protection they offer.

Strategies for Managing Costs

Strategies to manage costs include considering a shorter benefit period initially (potentially supplementing with savings), accepting a longer waiting period, opting for an any-occupation definition (if acceptable), and carefully comparing quotes from multiple insurers.

Visual Representation of Premium Cost, Benefit Level, and Policy Type

Imagine a three-dimensional graph. The X-axis represents the policy type (short-term, long-term, own-occupation, any-occupation), the Y-axis represents the benefit level (percentage of income replaced), and the Z-axis represents the premium cost. The graph would show a positive correlation between the Z-axis (cost) and both the X-axis (more comprehensive policies costing more) and the Y-axis (higher benefit levels costing more).

Long-term, own-occupation policies would occupy the highest point on the graph, indicating the highest cost, while short-term, any-occupation policies would be at the lowest point.

Finding and Selecting a Suitable Policy

Finding a qualified insurance broker or agent specializing in high-net-worth individuals is crucial for navigating the complexities of disability insurance. This section details the process of finding suitable professionals, comparing policy offers, and thoroughly reviewing policy documents.

Finding Qualified Insurance Professionals

Seek referrals from financial advisors, colleagues, or online resources specializing in high-net-worth insurance. Verify credentials and experience with high-income clients. Inquire about their expertise in disability insurance for tech professionals.

Comparing Policy Offers and Selecting Coverage

Obtain quotes from multiple insurers, ensuring consistent policy features for accurate comparison. Compare premiums, benefit levels, waiting periods, and policy definitions. Prioritize policies that adequately protect your income and align with your financial goals.

Thorough Review of Policy Documents

Before signing, carefully review all policy documents, including the policy contract, application, and any riders. Seek clarification on any unclear terms or conditions. Consult with your financial advisor or legal counsel if needed.

Step-by-Step Policy Evaluation, Disability insurance for high-income earners in tech USA

1. Assess your income and expenses: Determine the income replacement needed.

2. Define your needs: Own-occupation vs. any-occupation, benefit period, waiting period.

3. Obtain quotes: Compare premiums and features from multiple insurers.

4. Analyze policy documents: Understand terms, conditions, exclusions.

5.

Make informed decision: Choose the policy that best meets your needs and budget.

Tax Implications and Financial Planning: Disability Insurance For High-income Earners In Tech USA

Understanding the tax implications of disability insurance premiums and benefits is essential for effective financial planning. This section will explore these implications and how disability insurance integrates into a comprehensive financial plan for high-income tech professionals.

Tax Implications of Premiums and Benefits

Disability insurance premiums are generally not tax-deductible for individuals. However, in some cases, benefits may be tax-free depending on how the policy was purchased (e.g., through an employer). Consult a tax professional for specific guidance based on your individual situation.

Integrating Disability Insurance into a Comprehensive Financial Plan

Disability insurance should be a cornerstone of any comprehensive financial plan for high-income tech professionals. It protects against income loss, ensuring continued financial stability during periods of disability, complementing other aspects like retirement and estate planning.

Integrating with Other Financial Planning Tools

Disability insurance can be integrated with retirement planning by ensuring sufficient income during retirement, even if a disability occurs before retirement age. It also safeguards against potential estate planning issues arising from unforeseen disability-related expenses.

Examples of Protection Against Financial Losses

Scenario 1: A software engineer suffers a debilitating injury, preventing work for a year. Disability insurance replaces lost income, covering mortgage payments, living expenses, and healthcare costs. Scenario 2: A high-earning executive is diagnosed with a long-term illness requiring extensive treatment. Disability income ensures continued financial security for their family and avoids depleting savings.

Epilogue

Securing adequate disability insurance is paramount for high-income tech professionals in the USA. The potential for significant financial loss due to disability is substantial, making comprehensive coverage a vital component of a robust financial strategy. By understanding the various policy options, carefully evaluating cost-benefit trade-offs, and seeking professional guidance, tech professionals can effectively mitigate the risks associated with income disruption and protect their future financial well-being.

Proactive planning in this area empowers individuals to maintain financial stability and peace of mind, even in the face of unforeseen circumstances.

Essential FAQs

What is the difference between own-occupation and any-occupation disability insurance?

Own-occupation policies provide benefits if you are unable to perform the duties of your

-specific* occupation, even if you could perform another job. Any-occupation policies only pay benefits if you are unable to perform

-any* occupation for which you are reasonably suited by education, training, or experience.

How long is the typical waiting period for disability insurance benefits?

Waiting periods vary, typically ranging from 30 to 180 days. This is the period of time you must be disabled before benefits begin.

Can I deduct disability insurance premiums from my taxes?

The deductibility of disability insurance premiums depends on whether the policy is individually purchased or provided through an employer. Consult a tax professional for specific guidance.

What is a cost-of-living adjustment (COLA) rider?

A COLA rider increases your monthly benefit payments over time to help keep pace with inflation.