Car Insurance Comparison Tools A Comprehensive Guide

Car insurance comparison tools have revolutionized how consumers find the best coverage at the most competitive prices. These powerful online platforms aggregate data from multiple insurers, allowing users to compare policies side-by-side based on their individual needs and risk profiles. This comprehensive guide delves into the functionality, benefits, and potential drawbacks of these invaluable tools, offering insights into their design, data security, and the role of emerging technologies in shaping their future.

We will explore how these tools function, the data they utilize, and offer a comparative analysis of popular websites. Further, we will examine factors influencing insurance quotes, user experience considerations, and critical data privacy and security aspects. Finally, we’ll discuss the evolving technological landscape and its impact on the future of car insurance comparison tools.

Table of Contents

ToggleUnderstanding Car Insurance Comparison Tools

Car insurance comparison tools are invaluable resources for drivers seeking the best coverage at the most competitive prices. These online platforms aggregate quotes from multiple insurers, allowing users to compare options side-by-side and make informed decisions. Understanding their functionality and limitations is crucial for effective use.

Functionality of Car Insurance Comparison Tools

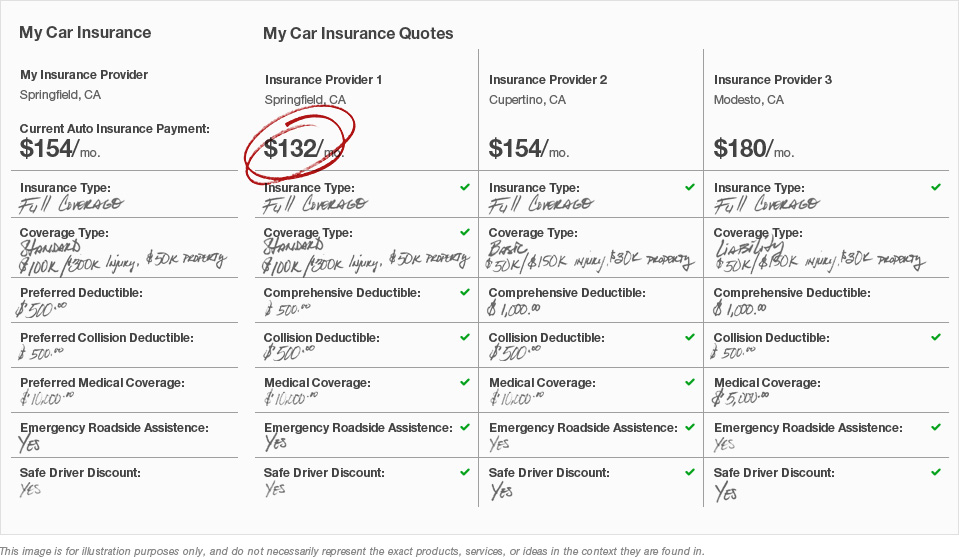

Typically, these tools function by collecting user-provided information about their vehicle, driving history, and desired coverage. This data is then transmitted to various insurance providers’ systems, which generate personalized quotes. The comparison tool then presents these quotes in a clear, organized manner, allowing users to compare premiums, deductibles, and coverage details. Most tools also offer filtering and sorting options to refine the results based on specific preferences.

Types of Data Used by Comparison Tools

Car insurance comparison tools utilize a wide range of data to generate accurate quotes. This includes demographic information (age, location), driving history (accidents, violations), vehicle details (make, model, year), and coverage preferences (liability, collision, comprehensive). Some tools also incorporate credit score information, as this can influence premiums in certain jurisdictions.

Comparison of Popular Car Insurance Comparison Websites

Source: carinsurancerates.com

Several popular websites offer car insurance comparison services, each with its strengths and weaknesses. Three leading examples include Compare.com, The Zebra, and NerdWallet. Compare.com is known for its extensive insurer network, The Zebra emphasizes user-friendly design, while NerdWallet provides comprehensive educational resources alongside its comparison tool. These platforms may differ in the insurers they partner with, the features they offer, and the overall user experience they provide.

Comparison Table of Car Insurance Comparison Tools

| Website Name | Key Features | Ease of Use | Data Accuracy (Perceived) |

|---|---|---|---|

| Compare.com | Wide insurer network, detailed quote comparisons, advanced filtering options | Good – straightforward interface, clear navigation | High – generally accurate quotes based on user input |

| The Zebra | User-friendly design, quick quote generation, personalized recommendations | Excellent – intuitive interface, minimal steps required | High – consistent with quotes obtained directly from insurers |

| NerdWallet | Comprehensive quote comparisons, educational resources, financial planning tools | Good – well-organized, but can feel slightly overwhelming for novice users | High – accurate quotes supported by editorial content |

Factors Influencing Car Insurance Quotes

Numerous factors contribute to the final cost of car insurance. Understanding these factors allows drivers to make informed decisions and potentially lower their premiums.

Key Factors in Premium Calculation

Insurance companies utilize complex algorithms to assess risk and determine premiums. These algorithms consider a multitude of factors, including driver demographics, driving history, vehicle characteristics, and coverage choices. Location plays a significant role due to variations in accident rates and theft statistics. The type of coverage selected (liability, collision, comprehensive) directly impacts the premium amount.

Impact of Driver Profiles

Age significantly influences premiums; younger drivers typically pay more due to higher risk profiles. Driving history, including accidents and violations, heavily impacts premiums. A clean driving record usually results in lower premiums. Location also plays a role, as premiums tend to be higher in areas with higher accident rates or crime.

Impact of Vehicle Characteristics

The make, model, and year of a vehicle affect insurance costs. Vehicles with a history of high repair costs or frequent theft tend to have higher premiums. Safety features such as anti-lock brakes and airbags can influence premiums favorably.

Top Five Factors Influencing Car Insurance Quotes

- Driving history (accidents, violations)

- Age and driving experience

- Vehicle make, model, and year

- Location (geographic area)

- Type and level of coverage selected

User Experience and Interface Design

Source: db-excel.com

The user experience of a car insurance comparison website is crucial for its effectiveness. A well-designed interface simplifies the process, making it easier for users to find the information they need and make informed decisions.

Analysis of a Popular Comparison Website’s User Interface

Many comparison websites prioritize speed and efficiency. However, some could improve by providing clearer explanations of insurance terminology and coverage options. More interactive tools, such as visual comparisons of coverage levels, could enhance the user experience. Additionally, personalized recommendations based on user-specific needs could improve decision-making.

Comparison of User Experiences

Comparing the user experiences of The Zebra and NerdWallet reveals differences in their approaches. The Zebra emphasizes a streamlined, minimalist design prioritizing speed and ease of quote generation. NerdWallet, on the other hand, offers a more comprehensive experience with detailed explanations and additional resources, potentially making it slightly more complex for users primarily focused on quick comparisons.

Suggestions for Improving User Experience

Improvements could include incorporating interactive elements, such as visual comparisons of coverage options. Clearer explanations of insurance terminology and personalized recommendations based on user profiles could also enhance the experience. Streamlining the data input process and providing progress indicators would improve the overall usability.

Mock-up Description of an Improved User Interface

An improved interface might feature a clean, intuitive layout with clear visual cues. A progress bar would indicate the user’s progress through the process. Interactive tools could allow users to compare coverage options visually, and personalized recommendations would be presented based on their specific needs and risk profile. The results page would display quotes in a clear, concise manner, highlighting key differences and allowing for easy filtering and sorting.

Data Privacy and Security Concerns

Using car insurance comparison tools involves sharing personal and sensitive information. Understanding the privacy risks and security measures employed by these websites is crucial for protecting user data.

Potential Privacy Risks

Sharing personal information with comparison websites carries inherent risks. Data breaches could expose sensitive information, such as driving history and financial details. The use of data for targeted advertising is another concern. Users should carefully review privacy policies to understand how their data will be used and protected.

Security Measures Employed by Reputable Websites

Reputable comparison websites employ various security measures, including encryption to protect data transmitted between the user’s device and the website’s servers. They often utilize robust firewalls and intrusion detection systems to prevent unauthorized access. Regular security audits and penetration testing are also common practices.

Comparison of Privacy Policies

A comparison of the privacy policies of Compare.com and The Zebra reveals similarities in their commitment to data security. Both websites state their commitment to data encryption and protection against unauthorized access. However, subtle differences might exist in their data retention policies or the types of third parties with which they share data.

Best Practices for Protecting Personal Information

- Only use reputable comparison websites.

- Review privacy policies carefully before submitting any information.

- Use strong, unique passwords.

- Be cautious about phishing attempts.

- Monitor your credit report for any suspicious activity.

The Role of Technology in Car Insurance Comparisons

Technology is transforming the car insurance comparison landscape, leading to more efficient and personalized services.

Impact of AI and Machine Learning

AI and machine learning are enhancing the accuracy and efficiency of car insurance comparison tools. These technologies can analyze vast amounts of data to identify patterns and predict risk more accurately. This allows for more personalized quotes and improved risk assessment.

Advantages and Disadvantages of AI-Powered Tools

AI-powered tools offer advantages such as faster quote generation, more accurate risk assessment, and personalized recommendations. However, concerns about algorithmic bias and the potential for discriminatory outcomes exist. Transparency in how AI algorithms function is crucial to ensure fairness and prevent bias.

Innovative Features Enabled by Technology

Technological advancements have led to innovative features such as telematics integration, allowing insurers to monitor driving behavior and offer discounts based on safe driving habits. Personalized recommendations based on individual risk profiles and advanced data analytics are also becoming increasingly common.

Hypothetical Future Iteration of a Comparison Tool, Car insurance comparison tools

A future iteration might incorporate advanced features such as real-time quote adjustments based on changing risk factors, such as weather conditions or traffic patterns. Predictive modeling could anticipate future needs, such as suggesting coverage upgrades based on anticipated life changes. Integration with other financial planning tools could further enhance the user experience.

Epilogue: Car Insurance Comparison Tools

In conclusion, car insurance comparison tools represent a significant advancement in consumer empowerment, simplifying a traditionally complex process. By leveraging technology and transparent data, these platforms offer users a powerful means to secure the most suitable and affordable car insurance. However, awareness of data privacy concerns and responsible usage remain crucial for maximizing the benefits while mitigating potential risks.

Careful consideration of the factors discussed herein will empower consumers to make informed decisions and secure optimal car insurance coverage.

Top FAQs

Are car insurance comparison tools completely accurate?

While comparison tools strive for accuracy, the information displayed is based on the data provided by insurance companies. Minor discrepancies can occur, and it’s advisable to verify details directly with the insurer before making a final decision.

Do comparison tools impact my credit score?

Reputable comparison websites generally do not directly impact your credit score. However, some insurers may perform a soft credit check as part of the quote process, which typically doesn’t affect your score.

What if I find a better quote after using a comparison tool?

Comparison tools are designed to help you find the best options. If you find a better quote elsewhere, you are free to pursue it. The tools are a resource to aid your decision-making, not a binding contract.

How do I ensure my data is secure when using these tools?

Choose reputable comparison websites with strong privacy policies and security measures, indicated by HTTPS and data encryption. Review their privacy policy carefully before submitting any personal information.