Best Auto Insurance for High-Value Cars in the USA

Best auto insurance for high-value cars in the USA is a crucial consideration for owners of luxury vehicles. Securing the right coverage protects a significant financial investment and ensures peace of mind. This guide explores top insurers, key factors influencing premiums, specialized coverage options, and strategies for obtaining the best rates, empowering you to make informed decisions about protecting your prized possession.

The unique challenges of insuring high-value vehicles necessitate a deeper understanding of policy nuances. From agreed-value coverage to considerations for modifications and customizations, navigating the insurance landscape requires careful planning. This comprehensive guide aims to provide clarity and equip you with the knowledge needed to confidently choose the best auto insurance for your specific needs and vehicle.

Table of Contents

ToggleIdentifying Top Insurers for High-Value Cars

Securing the right insurance for a high-value vehicle requires careful consideration of the insurer’s expertise in handling such assets. Several companies specialize in providing comprehensive coverage tailored to the unique needs of luxury and classic car owners. Choosing the right insurer can significantly impact your peace of mind and financial protection in the event of an accident or damage.

Top Insurers and Coverage Options

The following table lists ten insurance companies known for their experience with high-value vehicles, along with examples of their coverage highlights. Note that specific coverage options and pricing may vary depending on the vehicle, location, and driver profile.

| Make/Model Example | Insurer | Coverage Highlights | Agreed/Stated Value Options |

|---|---|---|---|

| Porsche 911 Turbo S | AIG Private Client Group | High coverage limits, specialized claims handling | Agreed Value |

| Ferrari 488 Pista | Chubb Insurance | Extensive coverage, global coverage options | Agreed Value |

| Rolls-Royce Cullinan | Hiscox | Classic car coverage, bespoke policy options | Agreed Value |

| Bentley Bentayga | American Collectors Insurance | Specializes in collector and classic cars | Agreed Value |

| Lamborghini Aventador | Hagerty | Classic and collector car insurance, valuation expertise | Agreed Value |

| Mercedes-Benz S-Class | State Farm (select high-value packages) | Broad coverage options, established network | Stated Value |

| BMW M5 Competition | Geico (select high-value packages) | Competitive pricing, user-friendly online tools | Stated Value |

| Audi R8 | Progressive (select high-value packages) | Wide range of coverage choices, strong customer service | Stated Value |

| Lexus LX | Nationwide (select high-value packages) | Bundled options, comprehensive coverage | Stated Value |

| Cadillac Escalade | Allstate (select high-value packages) | Widely available, various coverage levels | Stated Value |

Claims Process Examples

The claims process for high-value vehicles can vary among insurers. However, generally, it involves reporting the incident, providing documentation, and cooperating with the adjuster’s assessment. Below are examples from three insurers:

- AIG Private Client Group: Known for their personalized service, AIG typically assigns a dedicated claims adjuster to high-value claims, providing prompt communication and support throughout the process. They often work directly with specialized repair facilities to ensure the vehicle’s restoration to its pre-loss condition.

- Chubb Insurance: Chubb offers a streamlined claims process with 24/7 access to claims specialists. They emphasize clear communication and efficient handling of claims, prioritizing the restoration of the vehicle to its original condition using approved repair centers.

- Hagerty: Given their specialization in classic and collector cars, Hagerty’s claims process focuses on preserving the vehicle’s value and authenticity. They often utilize specialized restoration shops and experts to handle repairs and ensure the vehicle’s historical integrity.

Factors Affecting Insurance Premiums: Best Auto Insurance For High-value Cars In The USA

Several factors influence the cost of insuring a high-value car. Understanding these factors can help you make informed decisions and potentially secure more competitive rates.

Key Factors Influencing Premiums

Source: carinsurancerates.com

The cost of insurance for a high-value car is determined by a combination of factors, including the vehicle itself, the driver’s profile, and external circumstances.

- Vehicle Make and Model: Luxury and high-performance cars generally have higher repair costs and are more prone to theft, resulting in higher premiums.

- Driver’s History: A clean driving record with no accidents or violations typically leads to lower premiums.

- Location: Areas with higher rates of theft or accidents tend to have higher insurance premiums.

- Security Features: Vehicles equipped with advanced anti-theft systems or other security measures may qualify for discounts.

- Vehicle Usage: The frequency and purpose of driving (daily commute vs. occasional use) can affect premium costs.

- Coverage Level: Higher coverage limits and comprehensive coverage options naturally result in higher premiums.

Hypothetical Premium Comparison

Let’s compare the insurance costs for a hypothetical scenario involving a 2023 Mercedes-Benz S-Class and a 2023 Porsche 911 Carrera S, both driven by a 35-year-old driver with a clean driving record in a suburban area with average theft rates. The Porsche, due to its higher repair costs and theft risk, would likely command a significantly higher premium, even with similar coverage levels.

Impact of Different Coverage Levels

Choosing the right coverage level significantly impacts premium costs. Liability coverage, which covers damages to others, is typically mandatory. Collision coverage protects your vehicle in accidents, while comprehensive coverage extends to other incidents like theft or vandalism. Adding comprehensive coverage to a high-value vehicle increases the premium substantially, but offers greater financial protection.

Specialized Coverage Options

High-value car owners often benefit from specialized coverage options beyond standard auto insurance.

Agreed Value vs. Stated Value, Best auto insurance for high-value cars in the USA

| Agreed Value | Stated Value |

|---|---|

| Insurer agrees to a specific value for your car before the policy starts. In case of a total loss, you receive that agreed-upon amount, regardless of market fluctuations. | You state the value of your car, and the insurer assesses it. The payout in case of a total loss might be less than your stated value, depending on the insurer’s assessment of market value. |

| Higher premiums due to guaranteed payout. | Lower premiums, but potential for lower payout in case of total loss. |

| Provides greater certainty and peace of mind. | More affordable option, but involves risk. |

Coverage for Modifications and Customizations

It’s crucial to ensure that modifications and customizations to your high-value car are adequately covered. This may require separate endorsements or adjustments to your policy to reflect the increased value and potential repair costs. Failing to do so could result in under-insurance in the event of damage.

Other Specialized Coverage

Additional specialized coverage options that high-value car owners should consider include:

- Roadside Assistance: Provides coverage for towing, flat tire changes, and other roadside emergencies.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired.

- Coverage for Lost Use: Compensates for the loss of use of your vehicle while it’s being repaired after an accident or theft.

Tips for Obtaining the Best Rates

Securing competitive insurance rates for a high-value vehicle requires proactive steps and careful comparison shopping.

Strategies for Competitive Rates

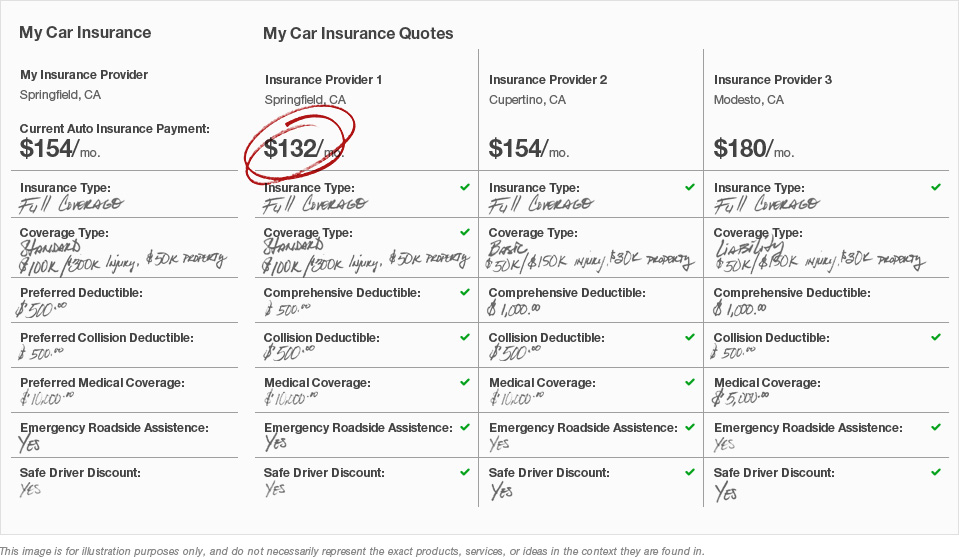

- Shop Around: Obtain quotes from multiple insurers to compare coverage options and prices.

- Bundle Policies: Consider bundling your auto insurance with other policies (homeowners, etc.) to potentially qualify for discounts.

- Maintain a Clean Driving Record: A clean driving record is a significant factor in determining your premiums.

- Improve Your Credit Score: In some states, credit scores influence insurance premiums.

- Consider Safety Features: Cars with advanced safety features may qualify for discounts.

Comparing Insurance Quotes

- Gather Information: Collect details about your vehicle, driving history, and desired coverage.

- Obtain Quotes: Request quotes from at least three different insurers, ensuring you’re comparing similar coverage levels.

- Analyze Quotes: Carefully review each quote, paying attention to coverage details, deductibles, and premiums.

- Compare Coverage: Ensure that the coverage offered is adequate for your needs and the value of your vehicle.

- Make a Decision: Choose the policy that best balances coverage, price, and your personal preferences.

Negotiating with Insurers

Don’t hesitate to negotiate with insurers. Highlight your clean driving record, safety features, and any other factors that might qualify you for discounts. Be prepared to compare offers from other insurers to strengthen your negotiating position.

Understanding Policy Exclusions and Limitations

It’s essential to understand the limitations and exclusions within your high-value car insurance policy to avoid surprises during a claim.

Common Exclusions and Limitations

- Wear and Tear: Normal wear and tear is typically not covered.

- Mechanical Breakdown: Unless specifically included as an add-on, mechanical breakdowns are usually not covered.

- Damage from Racing or Off-Road Use: Using your vehicle for racing or off-road driving may void coverage.

- Damage Caused by Neglect: Failure to maintain your vehicle properly may impact coverage.

- Certain Types of Modifications: Some modifications may not be covered unless specifically declared and approved by the insurer.

Filing a Claim

In case of an accident, promptly report the incident to your insurer. Provide accurate details of the accident, including date, time, location, and any witnesses. Cooperate fully with the insurer’s investigation.

Documentation for Claims

When filing a claim for damage to a high-value car, gather all relevant documentation, including:

- Police report (if applicable): A police report is often required for accidents involving other vehicles or significant damage.

- Photos and videos of the damage: Document the damage thoroughly with clear photos and videos.

- Repair estimates: Obtain estimates from reputable repair shops.

- Vehicle registration and insurance information: Provide all relevant documentation related to your vehicle and insurance policy.

End of Discussion

Protecting your high-value car requires more than just basic insurance; it demands a tailored approach that considers the vehicle’s unique characteristics and your individual needs. By understanding the factors that influence premiums, exploring specialized coverage options, and employing effective negotiation strategies, you can secure the best possible auto insurance for your prized possession. Remember to thoroughly review policy details and compare quotes from multiple providers to ensure you’re receiving comprehensive protection at a competitive price.

Safeguarding your investment is paramount, and this guide provides the tools you need to achieve that goal.

Questions Often Asked

What is agreed value insurance?

Agreed value insurance sets a predetermined value for your vehicle at the time of policy inception, guaranteeing that amount will be paid in the event of a total loss, regardless of the car’s market value at the time of the claim.

How does my driving record affect my premiums?

Your driving history significantly impacts your premiums. A clean record with no accidents or violations typically results in lower rates, while accidents or traffic violations can lead to higher premiums.

What security features reduce insurance costs?

Security features like anti-theft systems, GPS tracking, and alarm systems can lower your premiums as they reduce the risk of theft or damage.

Can I insure modifications and customizations?

Yes, you can often insure modifications and customizations, but it’s crucial to disclose them to your insurer and potentially obtain additional coverage to ensure they are adequately protected.

What is the claims process like for high-value cars?

The claims process for high-value cars is often more thorough than for standard vehicles. Expect detailed documentation, appraisals, and potentially negotiations with the insurer to determine the appropriate compensation for repairs or replacement.