How to Determine Your Car Insurance Coverage Limits

How to Determine Your Car Insurance Coverage Limits is a crucial question for every driver. Choosing the right coverage isn’t just about meeting minimum requirements; it’s about protecting your financial future. This guide will walk you through understanding different types of coverage, such as liability, collision, comprehensive, uninsured/underinsured motorist, and medical payments, helping you determine the appropriate limits based on your individual needs and circumstances.

We’ll explore factors influencing costs and provide practical advice for working with your insurance provider to secure the best possible protection.

Understanding your car insurance coverage limits is vital for financial security. This involves carefully considering various coverage types – liability, which protects you if you cause an accident; collision and comprehensive, which cover damage to your own vehicle; uninsured/underinsured motorist coverage, which protects you if you’re hit by an uninsured driver; and medical payments coverage, which helps with medical expenses.

By evaluating your assets, lifestyle, and driving habits, you can make informed decisions about coverage limits that provide adequate protection without unnecessary expense. This guide will empower you to confidently navigate the complexities of car insurance and select the coverage that best suits your needs.

Table of Contents

ToggleUnderstanding Liability Coverage: How To Determine Your Car Insurance Coverage Limits

Liability coverage is a crucial aspect of car insurance, protecting you financially if you cause an accident resulting in injuries or property damage to others. It’s important to understand the different types and how they apply to various scenarios.

Liability Coverage Types

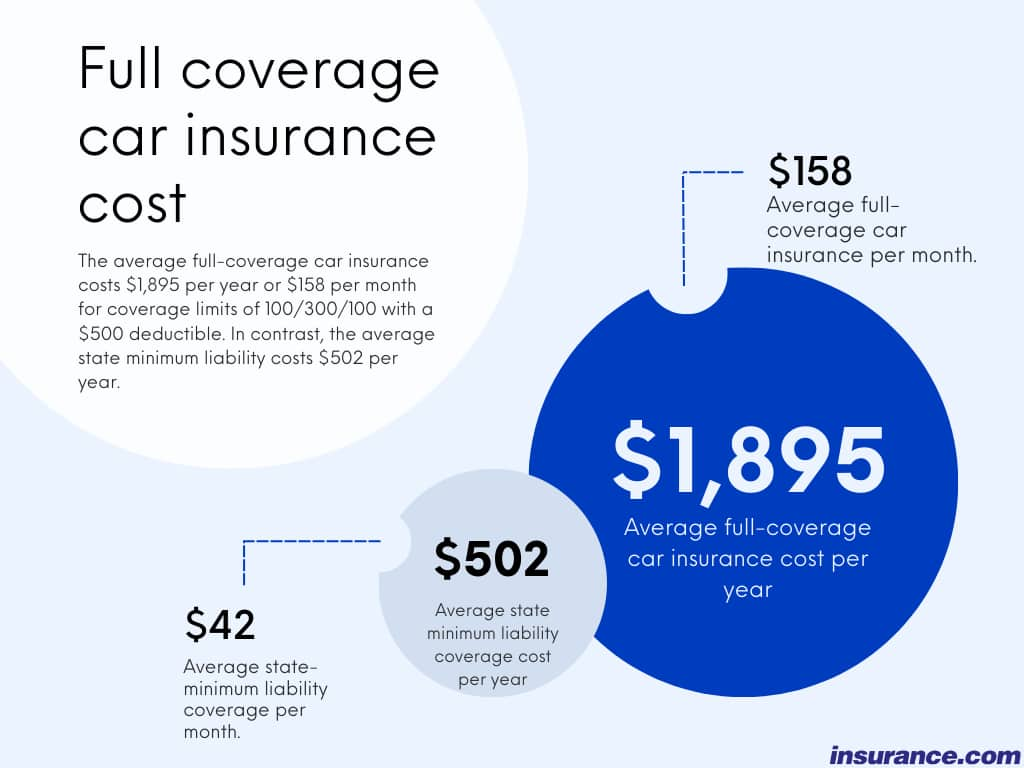

Source: insurance.com

Liability coverage typically includes two main components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident you caused. Property damage liability covers the cost of repairing or replacing damaged property, such as another person’s vehicle or fence.

Liability Coverage Scenarios

Consider these examples: You rear-end another car, causing injuries to the driver and significant damage to their vehicle. Your liability coverage would pay for the driver’s medical bills, lost wages, and pain and suffering (bodily injury), as well as the cost of repairing or replacing their vehicle (property damage). Another scenario: You accidentally back into a parked car, causing damage to its bumper.

Your property damage liability would cover the cost of repairing the other car.

Factors Influencing Liability Coverage Limits

Several factors influence the cost and limits of your liability coverage. These include your driving record (accidents, tickets), your location (higher risk areas generally mean higher premiums), the type of vehicle you drive (more expensive vehicles might require higher limits), and the amount of coverage you choose.

Minimum vs. Recommended Liability Limits

It’s vital to compare minimum state requirements with recommended higher limits. Minimum limits might not adequately cover the costs associated with a serious accident.

| Minimum Bodily Injury | Minimum Property Damage | Recommended Bodily Injury | Recommended Property Damage |

|---|---|---|---|

| $25,000 per person/$50,000 per accident | $10,000 | $100,000 per person/$300,000 per accident | $100,000 |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are optional but highly recommended additions to your car insurance policy. They protect you from various types of damage to your vehicle, but in different ways.

Collision vs. Comprehensive Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects.

Scenarios Requiring Collision and Comprehensive Coverage

Collision coverage is essential if your car is damaged in an accident, even if you’re not at fault. Comprehensive coverage is crucial if your car is damaged by something other than a collision, like a tree falling on it during a storm, or if it’s stolen.

Factors Influencing Collision and Comprehensive Costs

The cost of collision and comprehensive coverage is influenced by factors such as your vehicle’s make, model, and year (newer, more expensive cars are more costly to insure), your driving record, your location, and the deductible you choose (higher deductibles generally mean lower premiums).

Common Exclusions

- Damage caused by wear and tear

- Damage from gradual deterioration

- Damage intentionally caused by the policyholder

- Damage resulting from driving under the influence

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers if you’re involved in an accident caused by a driver who is uninsured or underinsured. This coverage is vital in situations where the other driver’s liability coverage is insufficient to cover your medical expenses and vehicle damage.

Scenarios Requiring Uninsured/Underinsured Motorist Coverage, How to Determine Your Car Insurance Coverage Limits

Imagine you’re involved in a serious accident caused by an uninsured driver. Your medical bills and vehicle repair costs could be substantial. Uninsured/underinsured motorist coverage would step in to cover these expenses. Another example: you are hit by an underinsured driver whose policy limits are lower than your medical bills. This coverage will cover the difference.

Uninsured vs. Underinsured Motorist Coverage

Uninsured motorist coverage protects you if the at-fault driver has no insurance. Underinsured motorist coverage protects you if the at-fault driver has insurance, but their coverage limits are too low to compensate you fully for your losses.

Factors to Consider When Determining Limits

- Your personal assets

- Your medical expenses potential

- Your vehicle’s value

- Your state’s minimum requirements

Medical Payments Coverage (Med-Pay)

Medical payments coverage (Med-Pay) is designed to pay for medical expenses for you and your passengers, regardless of fault, after a car accident. It’s a valuable addition to your policy, offering quick access to funds for medical care.

Med-Pay vs. Personal Injury Protection (PIP)

Med-Pay differs from PIP (Personal Injury Protection) in that PIP typically covers medical expenses, lost wages, and other related expenses, while Med-Pay primarily focuses on medical bills. PIP coverage is mandated in some states and may cover other individuals in your vehicle as well. Med-Pay is optional and the coverage amount may be limited.

Med-Pay in a Real-World Accident Scenario

Consider this: You’re in an accident, and you and your passenger sustain minor injuries. Med-Pay would cover your medical bills and those of your passenger, regardless of who caused the accident. This allows for prompt medical attention without worrying about immediate financial burdens.

Benefits of Adequate Med-Pay Coverage

A scenario highlighting the benefits: You’re involved in a fender bender. While your injuries are minor, the medical bills still add up. Adequate Med-Pay coverage will cover these costs, allowing you to focus on recovery instead of financial stress.

Determining Appropriate Coverage Limits

Source: kaltura.com

Choosing the right coverage limits is a crucial decision. Several factors should be considered to ensure you have adequate protection.

Factors to Consider When Selecting Coverage Limits

Your assets, lifestyle, driving habits, and the value of your vehicle all play a role. Someone with significant assets may need higher liability limits to protect those assets. A person who frequently drives long distances might consider higher limits to account for increased risk. The value of your vehicle should influence your collision and comprehensive coverage limits.

Consequences of Insufficient Coverage

Insufficient coverage can lead to significant financial hardship if you cause an accident resulting in substantial injuries or property damage. You could face lawsuits, debt, and even bankruptcy if your coverage limits are inadequate.

Costs Associated with Different Coverage Limits

Higher coverage limits generally mean higher premiums. However, the increased cost is often offset by the enhanced protection you receive. It’s essential to balance the cost of coverage with the potential financial risk you face.

Decision-Making Process for Choosing Coverage Limits

A flowchart illustrating this process would begin with assessing your risk factors (assets, driving habits, etc.), then comparing the costs of different coverage options, and finally selecting limits that balance protection with affordability.

Working with Your Insurance Provider

Working effectively with your insurance provider is key to obtaining the right coverage at a fair price.

Obtaining Quotes from Different Providers

Obtain quotes from multiple insurance companies to compare prices and coverage options. Use online comparison tools or contact companies directly.

Communicating Your Needs to Your Agent

Clearly explain your needs and concerns to your insurance agent. Discuss your driving habits, the type of vehicle you drive, and your risk tolerance.

Questions to Ask Your Insurance Provider

- What are the different coverage options available?

- What are the costs associated with each coverage level?

- What are the limits of liability coverage?

- What are the deductibles for collision and comprehensive coverage?

Negotiating Coverage Limits and Premiums

Don’t hesitate to negotiate with your insurance provider. Discuss ways to lower your premiums without sacrificing adequate coverage. This may involve increasing your deductible or exploring discounts.

Reviewing Your Policy Regularly

Regularly reviewing your car insurance policy is crucial to ensure it continues to meet your needs.

Importance of Annual Policy Review

Annual reviews help you identify potential gaps in coverage and make necessary adjustments as your circumstances change.

Updating Your Policy as Needs Change

Life changes, such as marriage, purchasing a new vehicle, or a change in driving habits, may require policy updates.

Situations Requiring Coverage Limit Changes

- Significant increase in assets

- Purchase of a more expensive vehicle

- Changes in driving habits (increased mileage)

Checklist for Reviewing Your Car Insurance Policy

- Review coverage limits

- Check deductibles

- Verify contact information

- Confirm discounts

Conclusive Thoughts

Determining the right car insurance coverage limits is a personal decision that requires careful consideration of your individual circumstances and risk tolerance. By understanding the different types of coverage available and the factors that influence their cost, you can make informed choices that protect your financial well-being. Remember to regularly review your policy and adjust your coverage as your needs evolve.

Proactive planning ensures you have the appropriate protection in place, offering peace of mind on the road.

Expert Answers

What happens if my coverage limits are too low?

If your coverage limits are too low and you’re involved in a significant accident, you could face substantial personal financial liability for damages exceeding your coverage. This could lead to bankruptcy or significant debt.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there’s a significant life change (new car, marriage, change in assets, etc.).

Can I change my coverage limits at any time?

Yes, you can typically adjust your coverage limits at any time by contacting your insurance provider. Note that changes may affect your premium.

What if I’m unsure about which coverage limits are right for me?

Consult with your insurance agent or broker. They can help you assess your risk and determine appropriate coverage limits based on your individual circumstances.