How to Find Affordable Car Insurance with Bad Credit

How to Find Affordable Car Insurance with Bad Credit is a crucial question for many drivers. A poor credit history often leads to significantly higher insurance premiums, making it challenging to find affordable coverage. This guide explores the relationship between credit scores and car insurance rates, offering practical strategies to secure competitive insurance even with less-than-perfect credit. We’ll delve into finding reputable insurers, comparing quotes effectively, and exploring options like non-standard insurance providers.

Ultimately, we aim to empower you to navigate the car insurance market and obtain the best possible coverage for your needs and budget.

Understanding the factors influencing your insurance costs is the first step towards securing affordable coverage. We’ll examine how insurers assess risk based on your credit history, driving record, and the type of vehicle you drive. By understanding these factors, you can take proactive steps to improve your position and negotiate better rates. We will also explore various coverage options, helping you select a policy that provides adequate protection without breaking the bank.

Table of Contents

ToggleThe Impact of Bad Credit on Car Insurance Rates

A poor credit history significantly impacts car insurance premiums. Insurance companies view credit scores as an indicator of risk. Individuals with bad credit are often perceived as higher-risk drivers, leading to increased premiums. This is because statistically, individuals with poor credit management tend to exhibit riskier behaviors in other areas of their lives, including driving.

Factors Considered in Credit Risk Assessment

Insurance companies utilize a variety of factors beyond credit score when assessing risk. These include your driving history (accidents, violations), age, location, the type of vehicle you drive, and the coverage you select. However, credit score often plays a substantial role in determining your final premium.

Comparison of Insurance Rates: Good vs. Bad Credit

The difference in insurance rates between individuals with good and bad credit can be substantial. Someone with an excellent credit score might qualify for significantly lower premiums compared to someone with a poor credit score, even if their driving records are identical. This disparity reflects the perceived higher risk associated with bad credit.

Credit Score and Premium Differences: Examples

For example, a driver with an excellent credit score (750+) might pay $800 annually for car insurance, while a driver with a poor credit score (below 600) might pay $1,500 or more for the same coverage. This significant difference underscores the importance of maintaining good credit.

Illustrative Table: Credit Score and Insurance Cost

| Credit Score Range | Premium Impact (Example) | Potential Factors | Notes |

|---|---|---|---|

| 750+ (Excellent) | Lowest Premiums | Clean driving record, safe vehicle | Significant savings compared to lower scores |

| 650-749 (Good) | Moderate Premiums | Minor driving infractions, average vehicle | Slightly higher than excellent scores |

| 550-649 (Fair) | Higher Premiums | Several driving infractions, older vehicle | Noticeable increase compared to good scores |

| Below 550 (Poor) | Highest Premiums | Serious driving violations, high-risk vehicle | Substantially higher than fair scores; may face difficulty finding coverage |

Finding and Comparing Affordable Car Insurance Options

Source: pinimg.com

Securing affordable car insurance with bad credit requires diligent research and comparison shopping. Several insurers specialize in working with drivers who have less-than-perfect credit histories.

Car Insurance Providers for Drivers with Bad Credit

- Progressive

- State Farm

- Allstate

- Geico

- Nationwide

Note: Availability and specific programs vary by state and individual circumstances. It is crucial to contact these companies directly to confirm their offerings.

Tips for Comparing Insurance Quotes

When comparing quotes, ensure you are comparing apples to apples – the same coverage levels from each insurer. Pay close attention to deductibles and policy limits. Obtaining multiple quotes allows for a more informed decision.

Understanding Policy Coverage Details

Different types of coverage exist: liability (covering damages to others), collision (covering damage to your vehicle), and comprehensive (covering damage from non-collisions like theft or vandalism). Understanding these distinctions is vital to choosing appropriate coverage.

Key Factors to Consider When Choosing a Policy

- Coverage levels

- Deductibles

- Premiums

- Customer service ratings

- Financial stability of the insurer

Strategies to Lower Car Insurance Costs with Bad Credit

While bad credit increases premiums, several strategies can help mitigate the impact and lower your overall costs.

Improving Your Credit Score

Improving your credit score is a long-term strategy with significant payoffs. Actions such as paying bills on time, reducing debt, and monitoring your credit report can lead to lower insurance premiums over time. Consider consulting a credit counselor for personalized advice.

Impact of Increasing Your Deductible

Raising your deductible (the amount you pay out-of-pocket before insurance coverage begins) will generally lower your premiums. However, carefully weigh this against your ability to afford a higher deductible in case of an accident.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, often results in discounts from many insurers. This is a simple way to save money.

Maintaining a Safe Driving Record

Maintaining a clean driving record is crucial. Avoiding accidents and traffic violations will demonstrate to insurers that you are a lower-risk driver, potentially leading to lower premiums. Defensive driving courses can also help.

Choosing a Less Expensive Car

The make, model, and year of your vehicle significantly influence insurance costs. Choosing a less expensive car to insure can lead to lower premiums. Insurance companies consider factors such as the car’s safety rating, repair costs, and theft rate when determining premiums.

Exploring Non-Standard Car Insurance Providers: How To Find Affordable Car Insurance With Bad Credit

Non-standard insurers specialize in providing coverage to high-risk drivers, often those with poor credit or extensive driving violations. They offer alternative options when standard insurers decline coverage.

Characteristics of Non-Standard Insurers, How to Find Affordable Car Insurance with Bad Credit

Non-standard insurers typically have higher premiums than standard insurers. They may also have more stringent underwriting requirements and offer less comprehensive coverage options.

Coverage Options and Pricing

Coverage options and pricing will vary greatly between non-standard and standard insurers. Non-standard insurers may offer less comprehensive coverage at a higher price to manage their risk.

Application Process and Requirements

The application process for non-standard insurance may be more rigorous, requiring more detailed information about your driving history and financial situation.

Situations Where Non-Standard Insurance May Be Best

Non-standard insurance might be the best option for drivers with multiple violations, poor credit, or a history of accidents who struggle to find coverage through standard insurers.

Comparison Table: Standard vs. Non-Standard Insurers

| Feature | Standard Insurer | Non-Standard Insurer |

|---|---|---|

| Premiums | Generally lower | Generally higher |

| Coverage Options | Wider range of options | More limited options |

| Underwriting | Less stringent | More stringent |

| Eligibility | Broader range of drivers | Primarily high-risk drivers |

Additional Resources and Support

Several resources can assist in navigating the complexities of car insurance and credit management.

Credit Counseling Services

- National Foundation for Credit Counseling (NFCC)

- Credit.org

- MyFICO

Navigating the Claims Process

Familiarize yourself with your policy’s claims process. Document all aspects of an accident, including photos and witness information. Contact your insurer promptly after an accident.

Understanding Your Insurance Policy

Thoroughly review your policy documents to understand your coverage, exclusions, and responsibilities. Don’t hesitate to contact your insurer if you have questions.

Resources for Accidents and Violations

Seek legal counsel if you’ve been involved in an accident or received a traffic violation. Legal representation can protect your rights and help you navigate the legal process.

Benefits of an Independent Insurance Agent

An independent insurance agent can provide unbiased advice and help you compare policies from multiple insurers. They can help you find the best coverage at the most competitive price.

Last Recap

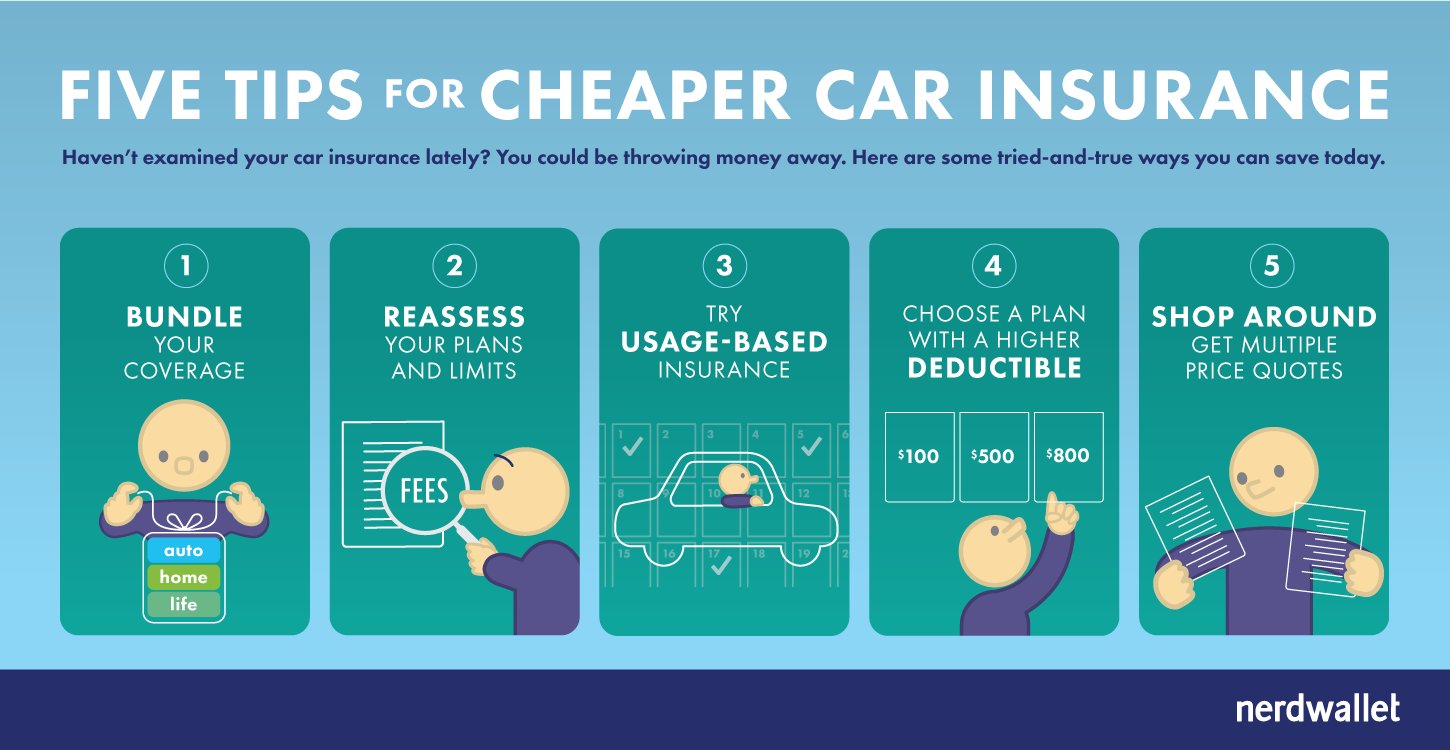

Source: nerdwallet.com

Securing affordable car insurance with bad credit requires a strategic approach. By understanding how credit impacts premiums, diligently comparing quotes from various insurers, and employing strategies to improve your credit score and driving record, you can significantly reduce your insurance costs. Remember to carefully review policy details, consider bundling options, and explore non-standard insurers if necessary. Taking control of your financial situation and demonstrating responsible driving habits can ultimately lead to more affordable and comprehensive car insurance.

Questions Often Asked

What if I’ve had multiple accidents?

Multiple accidents significantly impact your insurance rates. Be upfront with insurers about your driving history and consider seeking out high-risk insurance providers specializing in drivers with accident-filled records.

Can I improve my credit score quickly?

While significant improvement takes time, paying down debt, disputing errors on your credit report, and consistently paying bills on time can positively impact your score over time.

What is a non-standard insurer?

Non-standard insurers specialize in providing coverage to high-risk drivers who may be denied by standard insurers. They typically offer less comprehensive coverage but at a potentially higher cost.

How long does it take to see credit score improvements reflected in my insurance rates?

The timeframe varies, but you may see some impact after 6-12 months of consistently positive credit behavior. Contact your insurer directly to inquire about rate adjustments based on improved credit.